The below list is certainly not exhaustive but hopefully serves as a useful introduction for London home buyers.

Consumer information sites like the Home Owners Alliance have more in-depth resources such as this article on how to be aware of Estate Agents Tricks of The Trade.

1. Ignore asking prices

When deciding how much to offer, don’t become anchored to the asking price. It is essential your valuation is based of Sold Price data and and in-depth comparable analysis. We are currently overseeing a flat purchase at 25% below the initial asking price. Our clients could have secured a 15% ‘discount’ on this initial figure and still significantly overpaid.

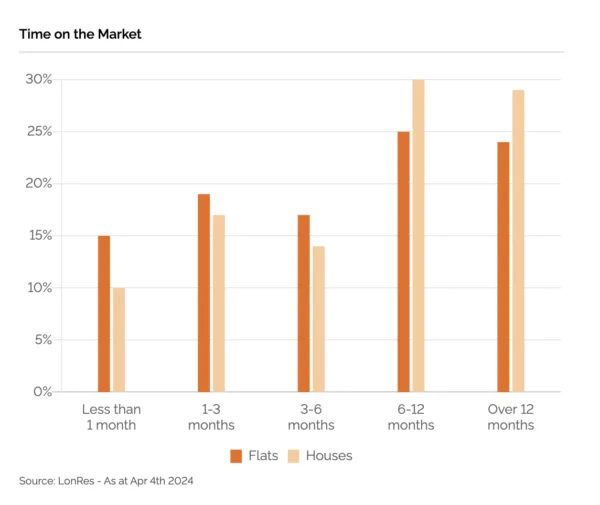

This approach is especially important in Prime Central London where it is not uncommon for properties to take over a year to sell after several price reductions. For instance, more than 50% of Chelsea houses take at least 6 months to sell.

Time on The Market: Chelsea (Source: LonRes: 2024)

2. Prepare

Although London’s property market can be sluggish, the best properties sell in less than a month if priced sensibly. The very best can transact in a matter of days, sometimes off market.

Therefore, it is vital you have everything ready before the right property appears so you can quickly put forward an offer in the best light possible. It is possible to win a competitive bidding scenario when your offer isn’t the highest by demonstrating to the selling agent that you are the most organised and serious party.

At the beginning of your search, have a solicitor, surveyor and financing in place. Ensure you understand the tax implications of the purchase and how this may impact your maximum offer level. Don’t assume your mortgage broker has factored this in. For higher value purchases in London, selling agents are particularly mindful of whether a buyer has already undergone the legally required anti-money laundering checks.

3. Choose your solicitor wisely

Your solicitor is responsible for advising on what is typically the largest investment of your life and explaining exactly what you are buying. Hiring a cheap one can be a false economy. Unfortunately too many buyers agonise over paying a few £100s more in legal fees, days after offering £10,000s more on a property with little due diligence.

Retaining a good law firm is especially vital in central London where the majority of purchases are leasehold flats. Before advising on your purchase, your solicitor will need to scrutinise the lease and how it interacts with increasingly complex legislation such as the Building Safety Act.

For new build or off plan purchases, avoid the developer’s recommended solicitor. There is simply too great a conflict of interest. On too many occasions one of our solicitors has identified serious flaws in a new build’s lease which the developer’s preferred solicitor had not rectified for other buyers.

4. Due diligence before viewings

Viewing numerous properties with significant flaws can be a frustrating process.

To limit the number of viewings and keep your sanity, you may want to clarify the following before booking viewings:

- The lease length, tenure (Freehold or Leasehold), service charge and ground rent.

- For flats, check if an EWS1 Certificate (cladding certificate) is in place.

- Understand the seller’s position and whether they are genuinely proceedable. Are they in a position to exchange contracts within 2 months?

- Look at the streetview/ 3D satellite images of the property – is there a school, pub or major infrastructure project nearby? What is the local planning environment like?

- Really study the floor plans. Remember room dimensions are typically given at the widest point and may not be reflective of overall size. Does the total square footage include restricted headheight areas?

- If you are particular about heigh ceilings, check if it’s on the floor plans or get a sense from the photos.

- The EPC (Energy Performance Certificate) rating.

5. Disregard most headlines

House prices garner significant media coverage to satiate the British public’s interest. Be wary of strong narratives built on weak data. A monthly 0.3% rise or fall of a stock price will not generate a single headline but it does with house prices.

During your search expect to read headlines like ‘House Prices Fall as Buyers become more cautious’ or ‘Property prices bounce back as (estate agent’s PR department) calls the bottom of the market.’ Neither are likely reflective of reality.

Remember, nobody really knows where the market will be in 6 months time.